Grab, Southeast Asia’s first decacorn valued at more than US$10 billion, began its humble beginnings as a ride-hailing app but has since evolved into one of the region’s “super app,” providing varied services ranging from food delivering, logistics services, and financial services across markets that include Indonesia, the Philippines, Vietnam, Thailand, Myanmar, and Cambodia.

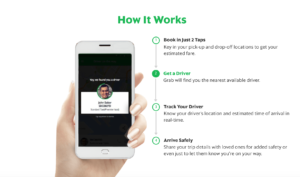

Grab mobile app

The Singapore-headquartered tech firm, originally from Malaysia, started expanding its offerings in 2015 with the introduction of its motorcycle rides service GrabBike but it’s only in 2016, that it unveiled plans to develop a payments platform, introducing the same year the GrabPay cashless digital wallet service.

Since then, Grab has acquired several ventures including Indonesian payments startup Kudo in February 2017 and Indian mobile payments startup iKaaz in January 2018, and has incorporated a wider range of payments options and financial services for users through its e-wallet GrabPay, including micro-loans and insurance products.

Last month, it unveiled a strategic partnership with UOB Bank to launch co-branded credit cards and introduce a top up method that would allow GrabPay users to top up their e-wallet directly from their UOB bank account.

GrabPay in Vietnam

In Vietnam, GrabPay has partnered with payments company Moca to launch GrabPay by Moca, a mobile wallet integrated into Grab’s app aimed at providing reliable and affordable financial services for the Vietnamese population.

Like most digital wallets, GrabPay by Moca allows users to link debit and credit cards and top up their stored-value wallets to pay for rides, food deliveries, airtime recharges and make in-store purchases, in addition to peer-to-peer payments.

GrabPay by Moca

Through the partnership, the companies seek to leverage each other’s strengths: Grab chose Moca for the startup’s local knowhow and access to licenses, while Moca’s mobile payments system is expected to gain traction through its integration with Grab.

Foreign players’ interest in the Vietnamese market comes at a time when digital payments in the country are booming. Over the first three quarters of 2018, cashless payments more than doubled in value. In particular, transactions over mobile apps and digital wallets rose by an impressive 126% and 161%, respectively, according to Department of Payments at the State Bank of Vietnam.

GrabPay’s Southeast Asian expansion

Image: Floating market, Banjarmasin City, Indonesia, Pixabay

But Vietnam isn’t the only market GrabPay is looking to establish a dominant position. Through partnerships with Maybank, OVO, and SM Investments Corporation, the digital wallet is also available in Malaysia, Indonesia, and the Philippines, respectively, in addition to Singapore. In November, it received US$50 million from major Thai banking group Kasikornbank to bring GrabPay to Thailand in 2019.

The company now plans to roll out a remittance service in early 2019 to tap into the region’s massive remittance market, which, according to the World Bank, is set to reach US$135 billion in 2018.

Grab’s remittance product will allow users to remit money instantly and securely to individuals in other countries using their GrabPay wallets. Receivers will be able to choose between cashing out via the regular network of cash-out points or use it on everyday transactions such as bill payments, and mobile airtime top ups.

One of Grab’s latest moves is the firm’s US$100 million investment in Indian hospitality chain OYO Hotels & Homes unveiled earlier this month. According to TechCrunch, Grab is interested in partnering with OYO to potentially boost its GrabPay service. GrabPay could become the preferred payments method for OYO in Southeast Asia.

“This creates another powerful use case for GrabPay in the rapidly growing travel market in the region,” a source close to Grab said, quoted by Skift. “For Grab, it’s about being accepted as the main method to pay in all kinds of core services for the growing middle class in Southeast Asia.”

OYO has more than 10,000 franchised or leased hotels in its network, spanning 350 cities across India, China, Nepal, Malaysia, and the UK. OYO has said it plans to use the funding to grow internationally with Grab helping it on expanding in Southeast Asia in particular.

Grab’s focus on Southeast Asia’s digital payments market comes as competition in the region is heating up. In Indonesia, Go-Jek, Grab’s main Southeast Asian rival, also views digital payments essential for corralling users within its digital ecosystem. The firm currently operates Indonesia’s fourth biggest digital wallet service Go-Pay.

Meanwhile, Chinese Internet giants including Alibaba have been making inroads into Southeast Asia. Alibaba partnered with Filipino conglomerate Ayala in 2017 and launched mobile payments at shopping malls and supermarkets, among other places.

Alibaba also owns about 20% of Thailand’s TrueMoney payments service, which has set out to overtake Rabbit Line Pay, the market-leading service from Japanese messaging app provider Line. About 60% of Thailand’s population uses the Line chat app with users of the mobile payments service estimated at about three million, according to Nikkei Asian Review.

Last week, Vietnamese tech startup Be Group Corporation launched its ride-hailing services BeBike and BeCar, joining the country’s already crowded sector that include the likes of FastGo, GoViet, Go-Jek, Aber, and of course, market leader Grab.

Featured image: Illustration via Grab.com.

The post GrabPay Eyes Vietnam and South East Asia Digital Payments Dominance as Competition Heats Up appeared first on Fintech Singapore.

Comments